Copyright © 2025

TaxArth Services Private Limited.

All Rights Reserved.

Several businesses started in India as Limited Liability Partnership (LLP), may now wish to convert into a private limited company for more growth in business or for infusing equity capital. An LLP can be converted into a Pvt. Ltd. company as per the provisions contained in Section 366 of the Companies Act, 2013 and Company (Authorised to Register) Rules, 2014.

An LLP must have at least 7 partners, approval from all the partners is required, advertisement in newspaper is to be done in a local and a national newspaper, a No Objection Certificate (NOC) is required from the ROC where such LLP is registered and then all the incorporation process has to be undertaken.

LLP to pvt ltd company

It offers limited liability, offers tax advantages, can accommodate an unlimited number of partners, and is credible in that it is registered with the Ministry of Corporate Affairs (MCA). At the same time, it has less compliance than a private limited company and is also significantly cheaper to start and maintain.

Unlike private limited company, you cannot raise equity funding in llp from any person other than its partner. However, debt funding such as term loan, overdraft from bank is possible.

There is no minimum capital requirement in LLP. An LLP can be formed with the least possible capital.

Gives the advantage of limited liability and also provides flexibility to organize their firm internally. Audit is not needed if an annual sale is more than Rs 40 lakhs and capital contribution does not cross the limit of Rs 25 lakhs. LLP is not bound to pay Dividend Distribution Tax (DDT).

LLP does not entertain the concept of shareholders. All the owners in a LLP are considered as Partners in the LLP and are considered as unsuitable for investors such as Venture Capitalists and Private Equity investors who do not possess any desire to indulge in the management of the Company. Private Company is the best choice for investors. If the business is growing, then the owners must convert it into a private limited company.

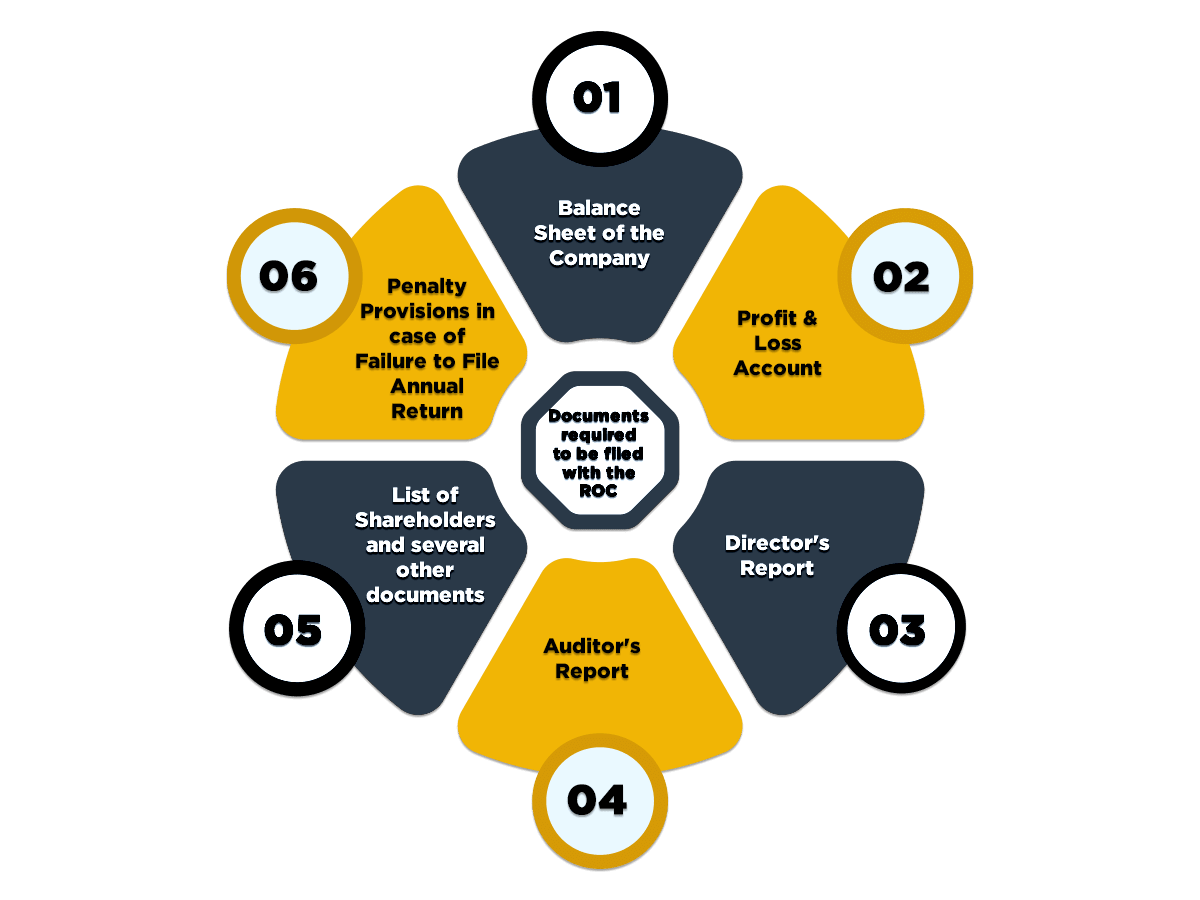

In case of more than 7 partners in the LLP at the time of conversion into Company then Company have to file Scan copy of physically prepared MOA & AOA. In above mentioned situation company have to file 1. URC-1 and 2. INC-32. No need of INC-33 and INC 34 in the above mentioned situations.

Three DIN can be applied through SPICe form.

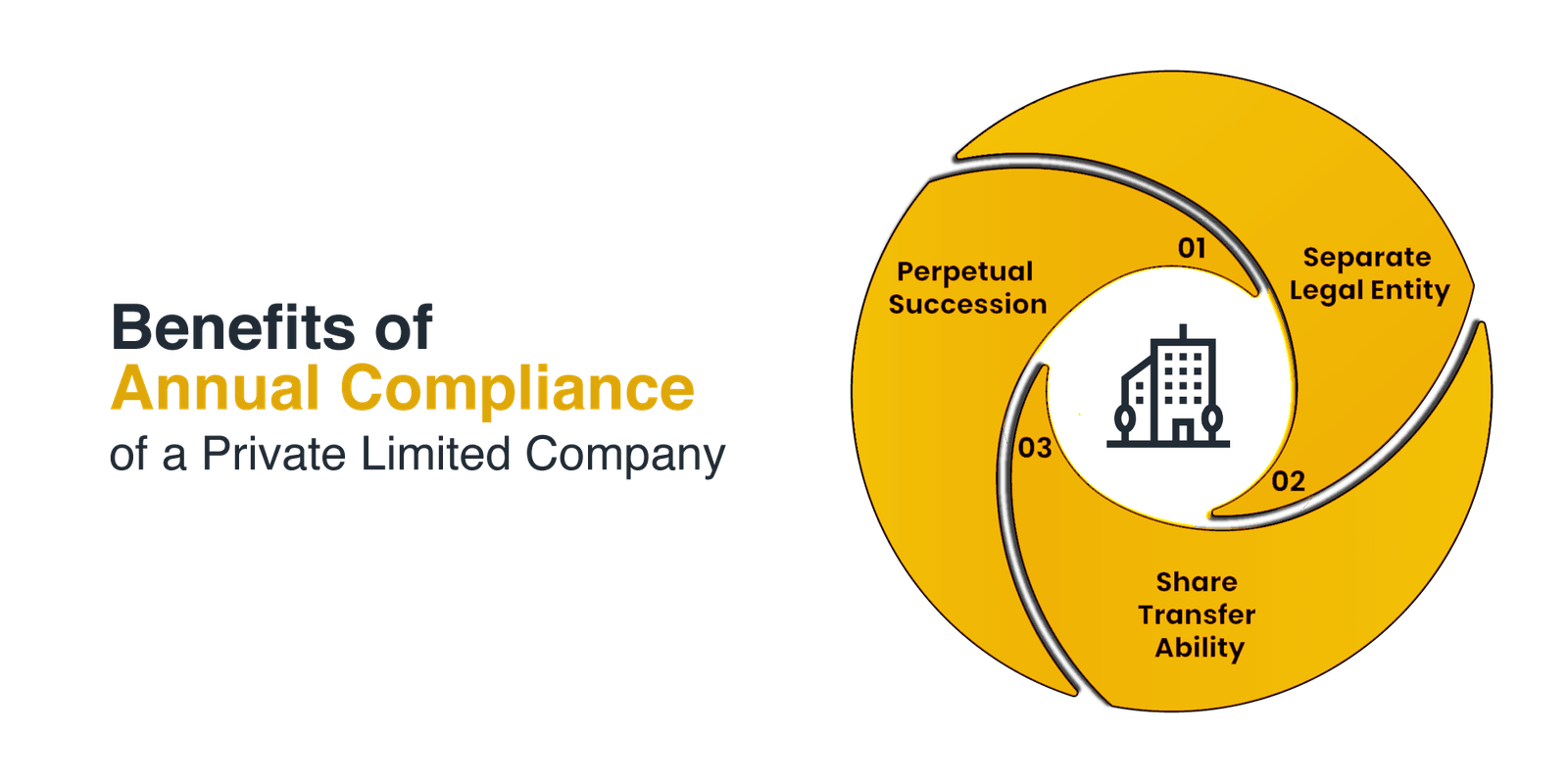

Preservation of Brand Value Carry forward of unabsorbed losses and depreciation Employee Stock Ownership Plan to employees Easy Fund Raising Separate Legal Existence Limited Liability of Owners

Memorandum of Association (MOA) is a document that contains all the fundamental data which are required for the company incorporation. Articles of Association (AOA) is a document containing all the rules and regulations that govern the company.

The Ministry of Corporate Affairs (MCA) mandates that the Directors sign some of the application documents using their Digital Signature. Hence, a Digital Signature is required for all Directors of a proposed Company. Digital Signature application is to be filed to obtain DSC.