Copyright © 2025

TaxArth Services Private Limited.

All Rights Reserved.

For companies looking to grow quickly and make changes constantly, Private Limited Company is the key. Company which is owned by non-governmental organizations or a relatively small number of shareholders or members of a company. A private limited company gives its members limited liability, allows equity to be raised easily, and ensures transparency in financials. The minimum requirement of a private limited company is two members, and there can be a maximum of 200 members.

For the registering a Private Limited Company, the concerned Ministry i.e. Ministry of Corporate Affairs (MCA) mandates the process of Incorporation by filing all the required forms on their online platform (www.mca.gov.in), which assures the fast and easy process.

The private limited company has many takers in India, with around 10,000 being registered each month. Registering a private limited company is easy. All you need is a suitable name, at least two directors who must apply for DINs and DSCs, articles and memorandum of association, and a few essential documents. The registration process, if effectively done, takes not more than two weeks.

1. PASSPORT SIZE PHOTO

2. PAN CARD

3. ADHAAR CARD

4. ID PROOF: any one of the following:

5. ADDRESS PROOF: any one of the following:

Once a name for the company is decided, the following steps have to be taken by the applicant:

Step 1: Apply for DSC (Digital Signature Certificate) and DIN (Director Identification Number)

Step 2: Apply for the name availability

Step 3: File the MOA and AOA to register the private limited company

Step 4: Apply for the PAN and TAN of the company

Step 5: Certificate of incorporation will be issued by RoC with PAN and TAN

Step 6: Open a current bank account on the company name

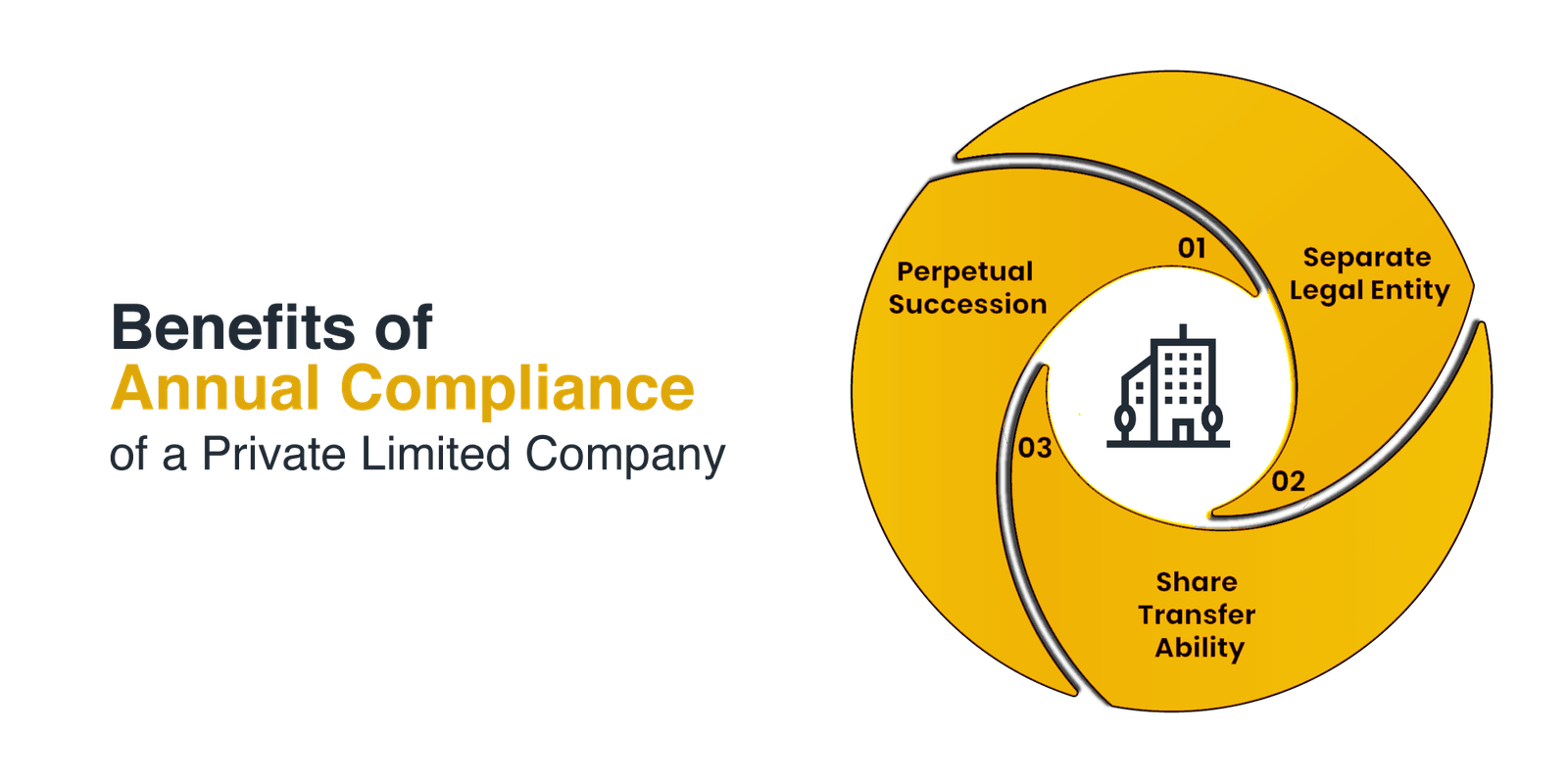

Separate legal entity

Easy transfer of shares

Higher borrowing capacity

Ownership

Confidential

Limited Liability

Difference between Private Limited Companies and Public Limited Companies?

| Point of Difference | Private Limited Company | Public Limited Company |

|---|---|---|

| Transferability of Shares |

Shares cannot be issued to the Public |

The shares can be issued to the public |

| Minimum and Maximum Members | Minimum - 2 Maximum - 200 | Minimum - 7 Maximum - unlimited |

| Minimum Directors | 2 directors | 3 directors |

| Minimum Paid-up Capital | 2 lacs | 5 lacs |

| Minimum Subscription | Can allot shares without completing minimum subscription. | Cannot allot shares without completing minimum subscription. |

| Certificate of Commencement of Business | Not Required | Required |

| Invitation to public | Not allowed | Allowed |

| Issue of Prospectus | Not Required | Mandatory |

| Term used at the end of the name | Private Limited | Limited |

| Statutory meeting | Not Mandatory | Mandatory |

| Managerial Remuneration | Cannot increase 11 percent of Net Profit. | No Restriction |

Difference between Private Limited Companies and Limited Liability Partnership?

| Point of Difference | Private Limited Company | Limited Liability Partnership |

|---|---|---|

| Minimum and Maximum Members |

Minimum - 2 Maximum - 200 |

Minimum - 2 Maximum - unlimited |

| Minimum Directors |

Minimum - 2 directors Maximum - 15 directors |

Minimum - 2 directors Maximum - not applicable |

| Term used at the end of the name | Privated limited | LLP |

| Statutory meeting | Mandatory | Not Mandatory |

| Board meeting | Necessary | Not Necessary |

| Registration Acts | Registered under Companies Act 2003 | Registered under LLP Act 2008 |

| Statutory Audit | Mandatory | Not compulsary under partner's contribution exceeds 25 lakhs or annual turnover exceeds 40 lakhs |

Private Limited Company

- There must be at least two directors and two shareholders - Each director must have a Directors Identification Number (DIN) - PAN card copy of directors/shareholders and Passport copy for NRI subscribers.

It is an 8 digit unique number with a lifetime validity assigned by Ministry of Corporate Affairs to any person intending to be a Director or an existing Director of a company. Whenever a return, application or any information relating to the company is submitted by a director, the DIN needs to be clearly mentioned on the same.

It is a legal document certifying that the company is registered and incorporated with the Ministry of Corporate Affairs.

Memorandum of Association (MOA) is defined under section 2(56) of the Companies Act 2013 which defines the constitution, powers and objects of the company. The Articles of Association (AOA) is defined under section 2(5) of the Companies Act. It details all the rules and regulations relating to the management of the company.

Central Board of Direct Taxes has come together with Ministry of Corporate affairs to provide Permanent Account Number (PAN) and Tax deduction Account Number (TAN) along with the company incorporation. Applicant Companies can submit a common application form SPICe (INC 32) on the MCA Portal.

A private limited company needs a minimum of 2 directors and a maximum of 15 directors to register a company.

For becoming a director in a company, no professional or educational qualification is required.

Minimum two directors are required to incorporate a private limited company. Companies Act, 2013, has introduced the concept of One Person Company (OPC) private limited, in which a single individual can start a private limited company. Thus, if you plan to incorporate OPC, you can incorporate it with only one director.

Yes, family members can become director and shareholder in the company.

An entity incorporated as a Private Limited Company, Partnership Firm or a Limited Liability Partnership can register themselves under the startup India scheme.

Yes, Private Limited Companies can raise monies from external investors in exchange of allotting shares of the company.

Yes, one can register the company at home address with proper documentation.