Copyright © 2025

TaxArth Services Private Limited.

All Rights Reserved.

The shift from traditional partnerships to Limited Liability Partnerships (LLPs) has increased in recent years. The reason behind this is that LLPs offer more flexibility, unlimited partners and the like. But the real driving force behind the shift is due to the fact that LLPs offer a major advantage in terms of limited liability. The strain on the personal assets of the partner is put to rest when it comes to LLPs since they are a hybrid of both a partnership and a private limited company. Small and medium-sized businesses find this type of organisation structure to suit their needs very well.

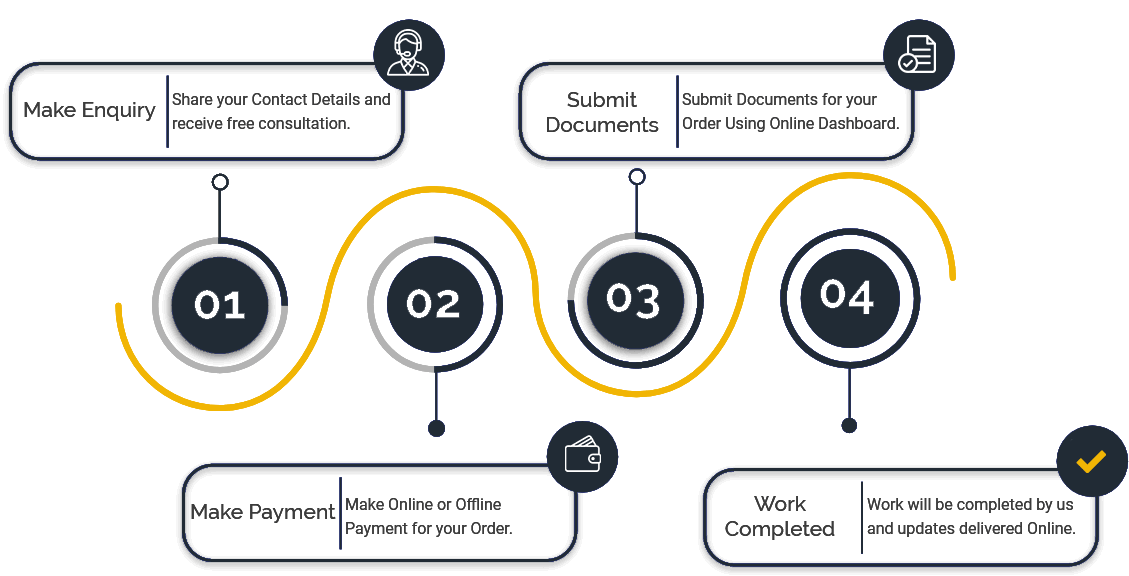

The advantages of the Limited Liability Partnership (LLP) form of business outweigh those of the traditional partnership. Limited liability, perpetual succession and unlimited partners are the key incentives for a partnership firm to convert itself into an LLP.

Step I – Name Approval and DSC

Step II – Filing of the Forms with the RoC

Step III – Issue of Registration Certificate

Step IV – LLP Agreement

Step V – Intimation to the Registrar of Firms

Partnership firm to LLP

No, registered as well as unregistered Partnership Firms can be converted into LLP.

Yes, as per the language of the law. The law is not anywhere asking for NOCs from unsecured creditors.

No, it is not possible. The entire partnership entity along with assets, liabilities, interests, rights, privileges, obligations is required to be transferred into the LLP.

Yes, it is possible.

Yes, the partners shall continue to be personally liable for all the acts done.

It is explicitly written in the Act that the LLP shall take all necessary as required by the necessary authority to notify the authority about such conversion and all assets of the partnership firm shall vest into the LLP without any further acts, deed or assurance.

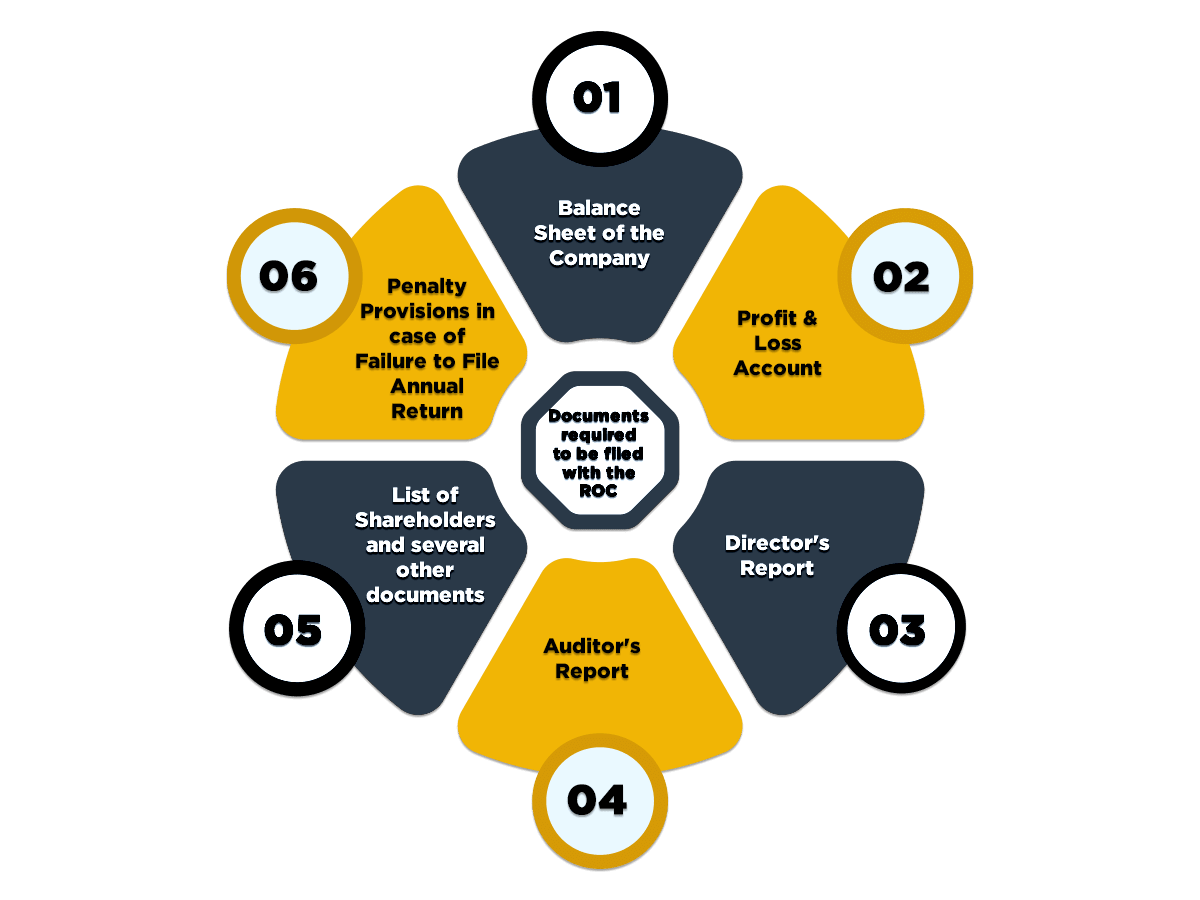

Every LLP would be required to file an Annual Return with ROC. LLP shall duly file Annual Return in e- Form-11, with the Registrar. Along with the prescribed fee, within a period of 60 days from the end of every financial year.

Both designated partners and partners are categorized differently in LLP. Additionally, the designated partners are more liable than the partners. Further, they are accountable for the day to day business activities as well as for all regulatory and legal compliances.

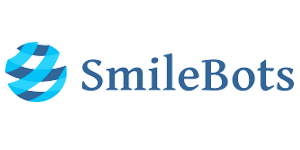

All the partners must obtain a DSC Next, they must obtain a designated partner identification number Once this is done, the company must look to get their name approved The name must include LLP at its end File LLP forms 17, 2, and 3

At least seven partners. Share capital worth at least INR 1 lakh Capital must be divided into either units or shares Object Clause from the partnership firm’s Memorandum of Association DSC and DIN of all the partners Memorandum of Association of the partnership Articles of Association Copy of the application for name approval NOC from the property owner

LLP shall have option to declare one more address within the jurisdiction of same ROC (other than the registered office) for getting statutory notices/letters etc. from Registrar