Copyright © 2025

TaxArth Services Private Limited.

All Rights Reserved.

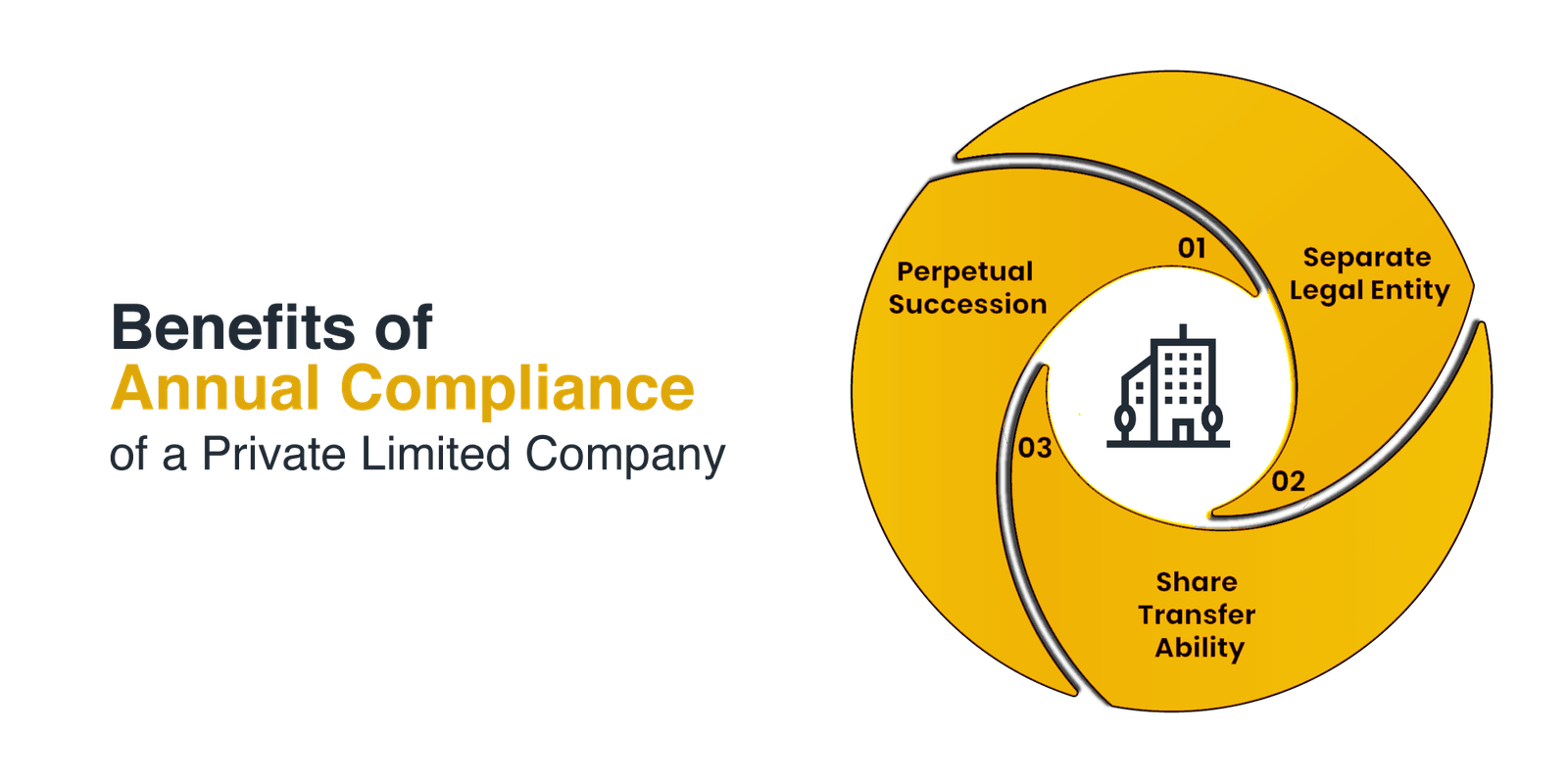

One Person Company is a separate legal entity having perpetual succession, which is required to be registered as per the provisions of the Companies Act, 2013. It is a company formed with only a single person as a member, unlike the traditional manner of having at least two members. It is essential for the member and nominee of the One Person Company to be a resident of India.

Difference between One Person Companies and Limited Liability Partnership?

| Point of Difference | One Person Company | Limited Liability Partnership |

|---|---|---|

|

Transferability of Shares |

Can be made by altering MOA |

Can be transferred by executing agreement before a notary public |

|

Minimum and Maximum Members |

Minimum - 1 Maximum - 1 |

Minimum - 2 Maximum - unlimited |

|

Minimum Directors |

Minimum - 1 Maximum - 15 |

Minimum - 2 Maximum - unlimited |

|

Registration Act |

Registered under Companies Act 2013 |

Registered under LLP Act 2008 |

|

Minimum Subscription |

Can allot shares without completing minimum subscription. |

Cannot allot shares without completing minimum subscription. |

|

Term used at the end of the name |

Should end with (OPC) Pvt. Ltd./ (OPC) Ltd. |

Should end with LLP |

|

Statutory meeting |

Not Mandatory |

Mandatory |

|

Board Meeting |

Necessary |

Not Necessary |

|

Statutory Audit |

Mandatory. |

Not compulsory unless partner’s contribution exceeds 25 lakhs or annual turnover exceeds 40 lakhs |

One Person Company

One Person Company can be formed with only one owner, who acts as both the director as well as the shareholder of the company. A nominee Director is mandatory but not more than one shareholder in a One Person Company.

Yes. Also a One Person Company is required to be converted into a private limited or public limited company on crossing a certain revenue number. Currently, in case of an average turnover of Rs. 2 crore or more for the three consecutive years or a paid-up capital of over Rs. 50 lakh, the OPC must mandatorily be converted into Private or Public Limited Company.

No an individual can start a single One Person Company at a time. This applies for the nominee director too.

We need DSC for filling of e-forms on online portal of MCA as the Ministry has provided for online registration procedure for company incorporation and other applications.DSCs are issued by the Certifying Authority in a token form and is valid for 1 or 2 years.

Documents required for DSC

It is an 8 digit unique number with a lifetime validity assigned by Ministry of Corporate Affairs to any person intending to be a Director or an existing Director of a company. Whenever a return, application or any information relating to the company is submitted by a director, the DIN needs to be clearly mentioned on the same.

It is a legal document required at the time of company formation. It is license to form a company, issued by the State Government. What is MOA and AOA? Known as the Company Charter, Memorandum of Association (MOA) and Articles of Association (AOA) define scope of work of a company and its internal management.

The MOA contains the following

Central Board of Direct Taxes has come together with Ministry of Corporate affairs to provide Permanent Account Number (PAN) and Tax deduction Account Number (TAN) in one day. Applicant Companies can submit a common application form SPICe (INC 32) on the MCA Portal.