Copyright © 2025

TaxArth Services Private Limited.

All Rights Reserved.

Conversion of Partnership firm into a Private Limited Company is a good option for anyone who wishes to expand small and medium scale enterprises to a large scale one, or for infusion of equity capital.

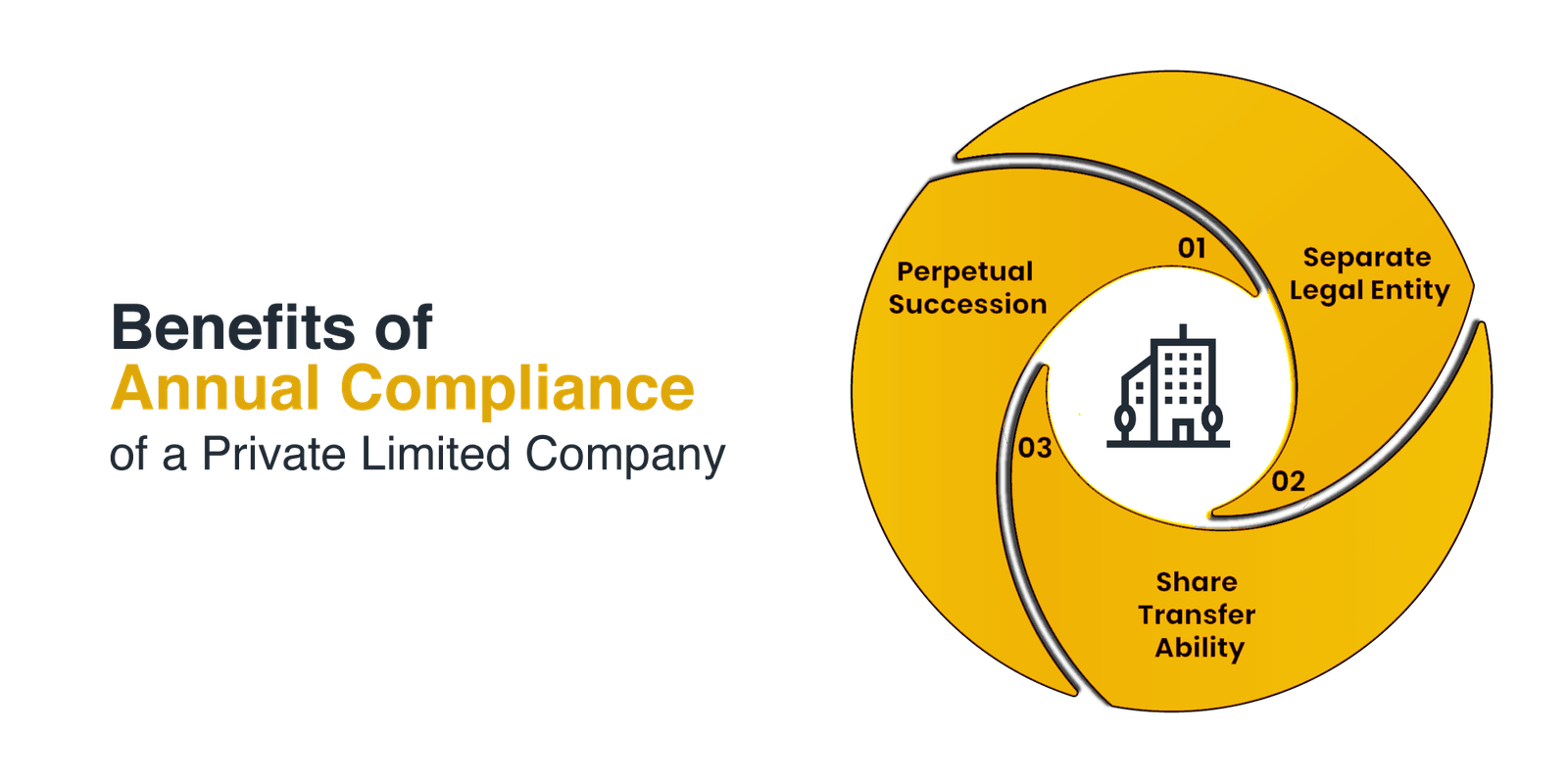

It has always been more advantageous to incorporate a company over a partnership firm. The members of the company enjoy the advantage of limited liability and perpetual succession. Section 366 of the Companies Act, 2013 deals with the entities capable of being registered under the Act. According to this section a co-operative society, an LLP, partnership firm, society or any other form of business entity formed under any other shall be converted into a company.

The major benefit of registering a Private Limited Company is that it has the status of a separate legal entity that a Partnership firm does not have. Private Limited Company Has Limited Liability whereas in the case of partnership firm partners are personally liable for each and every debt. Private Limited structure is more transparent than other business structures. PLC has its own advantages such as Limited Liability, Perpetual Succession, easy access to funds, etc.

Partnership firm to pvt ltd company

No Capital Gains tax or stamp duty shall be charged on transfer of property from Partnership firm to a Private Limited Company.

Following are the minimum requirements: Appointment of minimum 2 directors, out of which one must be a resident of India. Minimum requirement of 2 shareholders for this registration. Further, an individual may become shareholder and director at the same time. A place of business in India must be provided as a regd. office address

Yes, as per the Companies Act, 2013 the words Limited or Private limited has to be added at the end of the name of the company depending on its nature.

The Certificate of Registration is to be filed if the partnership firm is registered, in other cases it is not required.

There is no need to file a separate form, the details required for generating PAN and TAN are included in e-form INC-32.

SPICe eMOA and eAOA have to be uploaded as ‘linked forms’ to SPICe (INC-32).

Shareholders have limited liability. Raising the fund is easier in the company, as there is no restriction on the number of shareholders. Separate legal entity. Expansion and Diversification.

It shall be published in a newspaper, in English and in the principal vernacular language of the district in which office of such firm situated and should be circulated in that district.

There is no restriction upon the location of registered office of the proposed company after getting converted from partnership firm under the Companies Act, 2013. Proposed company may opt for different address for its registered office other than the address of the Partnership firm before conversion.

Reserve Unique Name (RUN) is a web service used for reserving a name for a new company or for changing its existing name. The web service helps you verify whether the name you've chosen for your company is unique.